👆

👆

Cryptocurrency: Revolution in Finance and Technology

Explore the world of cryptocurrency: from its history to modern technologies

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security and control over the creation of new units. The first and most well-known cryptocurrency is Bitcoin (BTC), introduced in 2009 by Satoshi Nakamoto (pseudonym) within a decentralized blockchain .

The main goal of cryptocurrency is to provide anonymity, security, and decentralization. It exists to offer an alternative to traditional forms of currency such as dollars or euros and to address several issues associated with centralized financial systems.

For those who prefer listening - listen to this paragraph

Some features of cryptocurrencies include:

- Transfer of funds: Cryptocurrencies allow for quick and inexpensive transfer of funds anywhere in the world without intermediaries such as banks. This is particularly relevant for international transfers.

- Investments: Many people view cryptocurrencies as a form of investment, hoping for an increase in the value of the cryptocurrency over time and making a profit.

- Smart contracts: Some cryptocurrencies, like Ethereum, support smart contracts, enabling the creation of programmable codes for automation and management of various agreements.

- Anonymous transactions: Some cryptocurrencies provide increased anonymity in transactions, which can be appealing to those who value privacy.

For those who prefer listening - listen to this paragraph

Where to get cryptocurrency and how to use it:

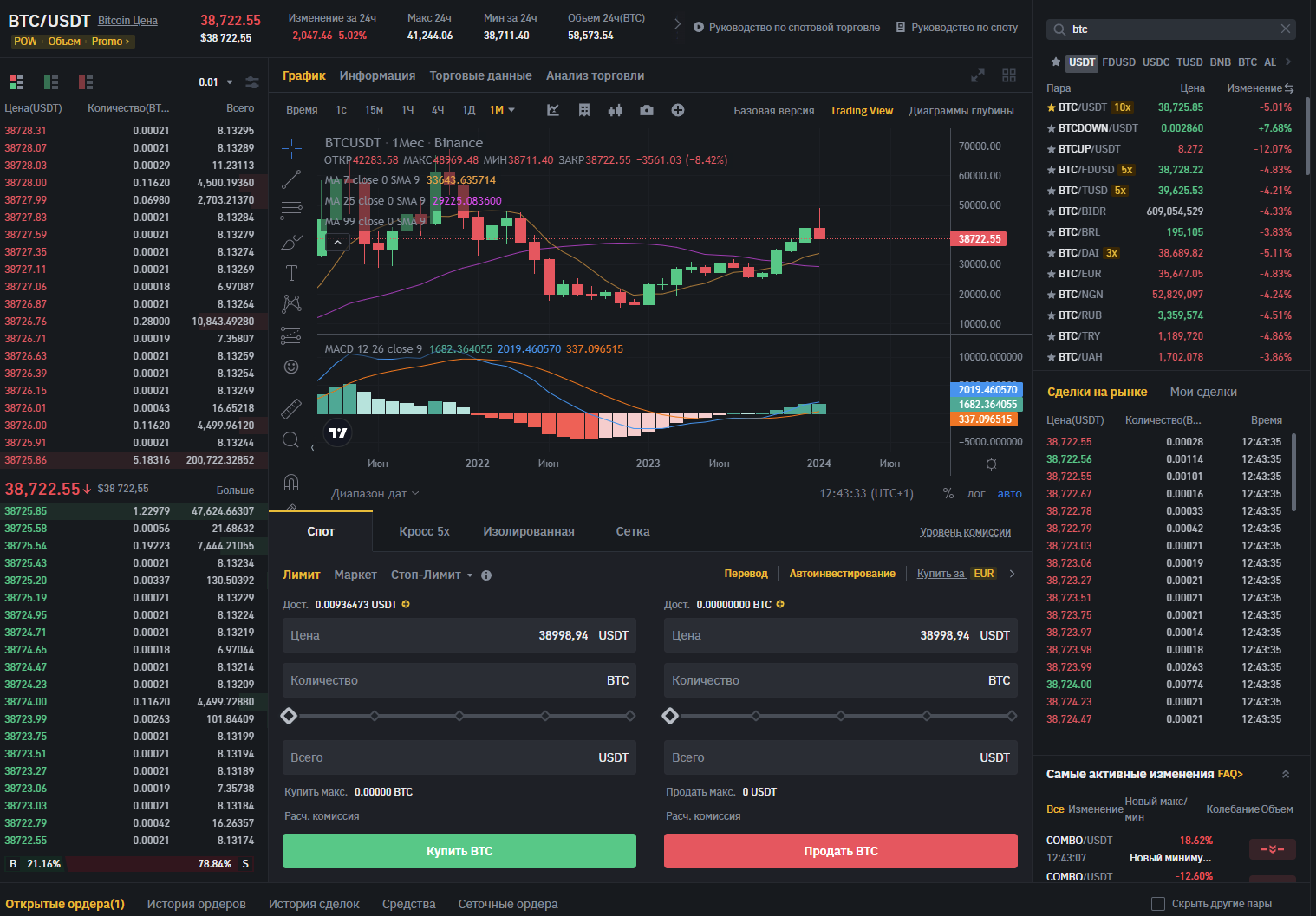

- Purchase on exchanges: You can buy cryptocurrency on specialized exchanges such as Bybit, Bingx, Kucoin, Binance and others. This often requires creating an account on the chosen exchange, undergoing verification, and then using traditional payment methods such as credit cards or bank transfers.

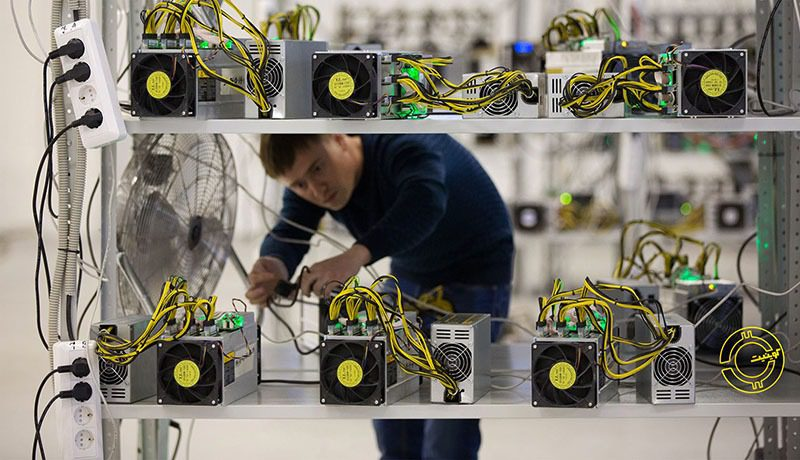

- Mining: Some cryptocurrencies can be mined using computational power. This process is called mining. However, for most cryptocurrencies, mining requires significant resources and technical skills.

- Received as a gift or in exchange for goods and services: Some people may receive cryptocurrency as payment for their goods or services or simply as a gift from other users.

For those who prefer listening - listen to this paragraph

Storage and Use of Wallets: After purchasing cryptocurrency on an exchange, you can store it in a digital wallet. The wallet can be online, offline, hardware-based, or even a paper medium. With a wallet, you can send and receive cryptocurrency.

Cryptocurrency is a constantly evolving topic, and new aspects may emerge over time.

DeFi (Decentralized Finance): Blockchain technology enables the creation of decentralized financial applications (DeFi) that provide services typically offered by banks without the need for intermediaries. This includes lending, trading, and insurance.

NFTs (Non-Fungible Tokens): Non-fungible tokens are unique digital assets recorded on the blockchain. They are often used in art, music, and gaming to verify authenticity and ownership of digital objects.

DEX, or decentralized exchange, is a type of cryptocurrency exchange that has no central governing authority. Instead, it uses smart contracts to facilitate trading between users.

Examples of DEX

Here are some of the most popular DEX:

- Uniswap

- PancakeSwap

- SushiSwap

When and Why DEX was Created

The first DEX, EtherDelta, was created in 2017. It was built on the ERC-20 protocol, allowing the creation of smart contracts for cryptocurrency exchange.

DEX was created to address some issues associated with centralized exchanges. For instance, centralized exchanges may be vulnerable to hacks and can freeze user accounts. DEX, on the other hand, does not have these drawbacks as they employ decentralized technology.

Advantages and Disadvantages of DEX

DEX has several advantages compared to centralized exchanges. These include:

- Decentralization: DEX has no central governing authority, making them more secure and resistant to hacks.

- Privacy: DEX does not require users to disclose personal information, providing greater privacy.

- Freedom: DEX is not regulated by governments, giving users more freedom.

However, DEX also has some disadvantages, including:

- Complexity: DEX can be more challenging to use than centralized exchanges.

- Speed: DEX may be slower than centralized exchanges.

- Liquidity: DEX may have lower liquidity compared to centralized exchanges.

Conclusion

DEX is a growing segment of the cryptocurrency market. They offer a range of advantages over centralized exchanges but also come with some drawbacks.

Environmental Concerns: The process of cryptocurrency mining, especially Proof-of-Work (PoW), consumes a significant amount of energy. This has led to discussions about the environmental sustainability of cryptocurrencies and the emergence of more energy-efficient alternatives.

For those who prefer listening - listen to this paragraph

U.S. Securities and Exchange Commission (SEC) - is an independent federal agency responsible for regulating the securities market in the United States. The Commission was established in 1934 under the Securities Exchange Act, which was enacted in response to the 1929 stock market crash.

SEC has a broad range of powers, including:

- Securities Registration: The Commission requires all new securities offered for sale in the U.S. to be registered with the SEC. This helps investors obtain information about the securities they are purchasing.

- Market Securities Regulation: The Commission ensures that securities markets operate fairly and efficiently. It also takes action against fraud and market manipulation.

- Investigating Violations: The Commission conducts investigations into potential violations of securities laws. If the Commission finds evidence of a violation, it may take actions, including fines, work bans, or even imprisonment.

SEC is headquartered in Washington, D.C. It has offices in 15 U.S. cities, as well as in London, Hong Kong, and Tokyo.

SEC's Approach to Cryptocurrencies

SEC treats cryptocurrencies as securities if they meet the Howey Test, developed in 1946. The Howey Test determines whether an asset is a security based on the following criteria:

- Promise of Future Benefits: The asset must promise future benefits, such as income or capital gain.

- Publicity: The asset must be offered to the general public.

- Investment Character: Investors must view the asset as an investment rather than a consumable good.

If the SEC deems a cryptocurrency to be a security, it may require its issuer to register it with the Commission. If the issuer fails to register the cryptocurrency, the Commission can take actions, including fines or work bans.

SEC may also view cryptocurrencies as instruments used for fraud or market manipulation. In such cases, the Commission can take actions against individuals involved in such activities.

SEC and Cryptocurrencies in 2023

In 2023, the SEC continued to pay close attention to cryptocurrencies. The Commission conducted investigations into several cryptocurrency exchanges and companies offering cryptocurrencies.

In June 2023, SEC filed a lawsuit against Binance, the world's largest cryptocurrency exchange. The Commission accused Binance of operating in the U.S. without registering as a securities exchange. As part of settling the lawsuit, Binance agreed to pay a fine of $1.5 billion and modify its business processes to comply with U.S. laws.

Also in June 2023, SEC filed a lawsuit against Ripple, the company behind the cryptocurrency XRP. The Commission accused Ripple of selling XRP in the U.S. without registering as securities. As part of settling the lawsuit, Ripple agreed to pay a fine of $1.3 billion and modify its business processes to comply with U.S. laws.

These lawsuits demonstrate that the SEC intends to actively regulate cryptocurrencies. This could have significant consequences for the cryptocurrency industry.

For those who prefer listening - listen to this paragraph

What is Arbitrage, Where is it Applied, and How Does it Work?

Arbitrage is an investment strategy involving the purchase of an asset on one market and simultaneous sale on another market to profit from price differences.

Arbitrage can be conducted across various markets, including financial markets, commodity markets, real estate markets, and securities markets.

History of Arbitrage

Arbitrage dates back to ancient times. For example, in Ancient Greece, traders used arbitrage to profit from price differences in grain across different ports. In the Middle Ages, arbitrage was widely used in the trade of precious metals.

In the modern world, arbitrage has become more complex and technological. The development of information technology has allowed arbitrageurs to access real-time price information for various assets, significantly enhancing the efficiency of arbitrage operations.

Who Created Arbitrage?

There is no precise answer to who created arbitrage. However, it can be speculated that it was devised by traders seeking to profit from price differences in goods and services.

What is Arbitrage Used For?

Arbitrage can be used for various purposes, including:

- Investments. Arbitrage can be used to profit from price differences in different assets.

- Insurance. Arbitrage can be used for risk mitigation against price changes.

- Trading. Arbitrage can be used to gain a competitive advantage in trading.

Examples of Popular Arbitrage Websites

There are numerous websites that provide information about prices for various assets. Among the most popular arbitrage websites are:

- Finviz

- Yahoo Finance

- Google Finance

- Investopedia

Examples of Arbitrage Deals

Here are some examples of arbitrage deals:

- Buy shares of a company on an exchange in one country and simultaneously sell them on an exchange in another country where the price is higher.

- Buy currency on one market and simultaneously sell it on another market where the exchange rate is higher.

- Buy a commodity on one market and simultaneously sell it on another market where the price is higher.

The Arbitrage Process

The arbitrage deal usually involves the following stages:

- Market Analysis: At this stage, the arbitrageur must identify markets where there is a price difference for the same asset.

- Risk Assessment: At this stage, the arbitrageur must assess potential risks associated with the arbitrage deal.

- Deal Execution: At this stage, the arbitrageur must buy the asset on one market and simultaneously sell it on another market.

- Profit Accounting: At this stage, the arbitrageur must account for the profit from the arbitrage deal.

Arbitrage as a Means of Earning

Arbitrage can be a profitable way to earn. However, like any other form of investment, arbitrage comes with certain risks. Arbitrageurs must possess special knowledge and skills to engage in arbitrage successfully.

There are cryptocurrency scanners that allow finding arbitrage opportunities, situations where the price of the same cryptocurrency differs on different exchanges. Such scanners gather data on cryptocurrency prices from various exchanges and analyze them to identify arbitrage opportunities.

But remember that cryptocurrency is a rapidly evolving area, and new aspects may emerge at any moment. It is recommended to stay updated with news and research in this field for current information.

Some Popular Cryptocurrency Arbitrage Scanners:

- ArbitrageScanner

- Arby Trade

- P2P.Army

- Monetary

- P2PMachine

These scanners offer various features and capabilities, so it's important to choose the one that suits you. Some factors to consider when choosing a scanner include:

- Price

- Exchange coverage

- Functionality

- User-friendliness

Cryptocurrency scanners can be a useful tool for cryptocurrency arbitrage, but it's crucial to remember that arbitrage involves certain risks. For example, exchanges may face liquidity and order execution issues, leading to losses. Transaction fees should also be taken into account, as they significantly impact the final income.

Tips for Using Cryptocurrency Arbitrage Scanners:

- Start with small amounts

- Don't rely solely on the scanner

- Study the cryptocurrency market

For those who prefer listening - listen to this paragraph

Start with small amounts to test your strategies and assess risks. Don't rely solely on the scanner; always conduct your market analysis. Study the cryptocurrency market to better understand how it operates and the factors influencing prices.